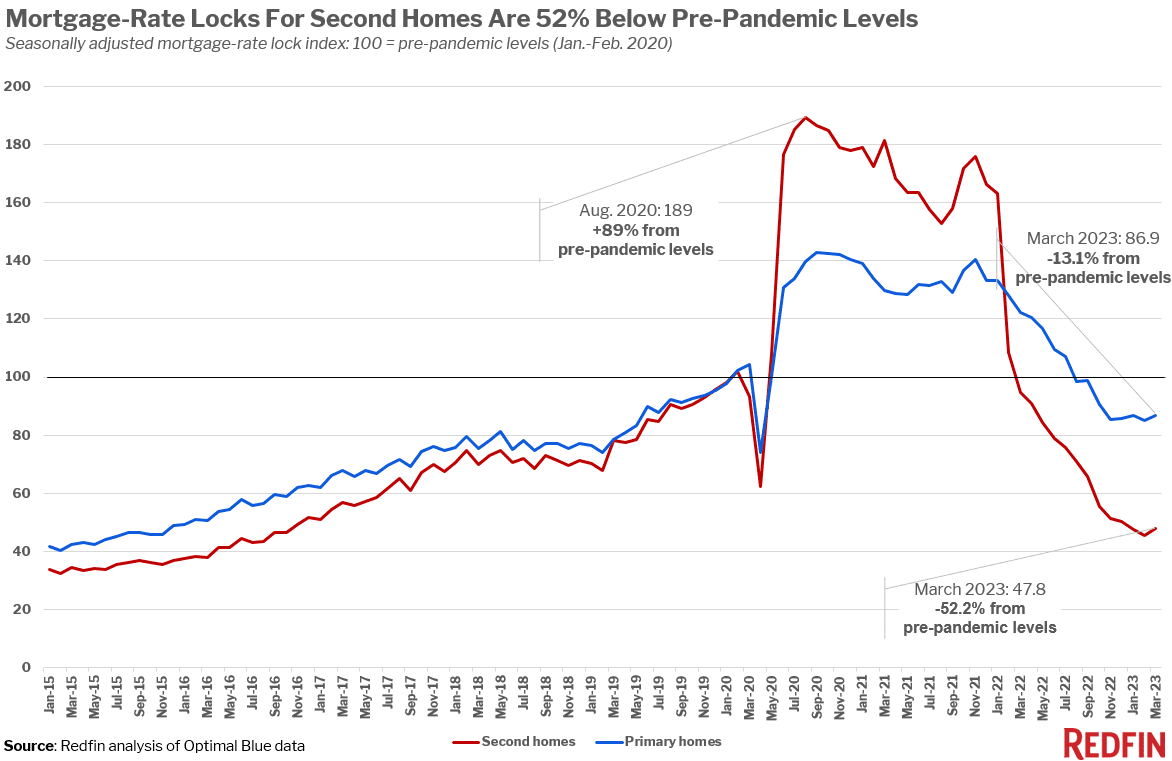

In March 2020 mortgage-rate locks dropped dramatically with the uncertainty at the outset of the COVID-19 pandemic, but by August of that year they saw a massive spike. The increase was even larger in second homes than in primary homes – mortgage-rate locks on second homes increased a whopping 89% over pre-pandemic levels! Record-low mortgage rates and financial stimulus payments made it easier to afford a second property. For many who were facing the reality of working from home for the foreseeable future, a second home could be used as a getaway.

But in March of this year, mortgage-rate locks are down 52% from pre-pandemic levels. So are second homes a luxury of the past? That could very well be the case, for now. We’re seeing that second-home buyers are being priced out of the market because it’s often more expensive to buy a vacation home than a primary home. The average second home was worth $465,000 in 2022, versus $375,000 for a primary home. Also, the federal government increased loan fees for second homes in April 2022. When you add in skyrocketing mortgage rates and low supply, second-home buyers are more likely to sit out the current market than people searching for primary homes.

It’s also becoming less attractive to buy a vacation home to rent it out. Owners of short-term rentals have reported a massive decline in business as workers are returning to the office. It looks like the demand for second homes might be concentrated in popular vacation destinations, especially to affluent cash-buyers who don’t need to worry about rising rates.